Are you looking to get into CFD Swing Trading? If so, then you’ve come to the right place. This article will provide helpful tips for CFD Swing Traders focused on achieving intermediate gains from taking and holding longer-term market positions. From showing how to properly read charts while examining the types of orders used and strategies employed during swing trading sessions, this article has it all wrapped up for those making their foray into SWFX market movements.

Whether your goal is maximising potential returns or limiting losses, using these simple yet highly effective tips provided herein, you can confidently set yourself on a path towards successful trade outcomes.

Understand the Basics of Swing Trading and CFD Strategies

Swing trading and CFD strategies are two popular methods investors use to trade in financial markets. Swing trading involves holding positions for a few days to several weeks to potentially profit from the price swings during that period. On the other hand, CFDs or Contracts for Difference allow investors to trade on the price fluctuations of an underlying asset without owning it outright.

These strategies can be lucrative if executed correctly, but they require a deep understanding of technical analysis and risk management. By learning the basics of these methods, investors can make informed decisions in the dynamic world of finance. It is imperative to note that swing trading and CFD strategies carry a high level of risk and may not be suitable for everyone. Therefore, before implementing any trading strategy, it is crucial to consult with a financial advisor and thoroughly research the potential risks involved.

Perfect Your Entry, Exit and Stop-Loss Points

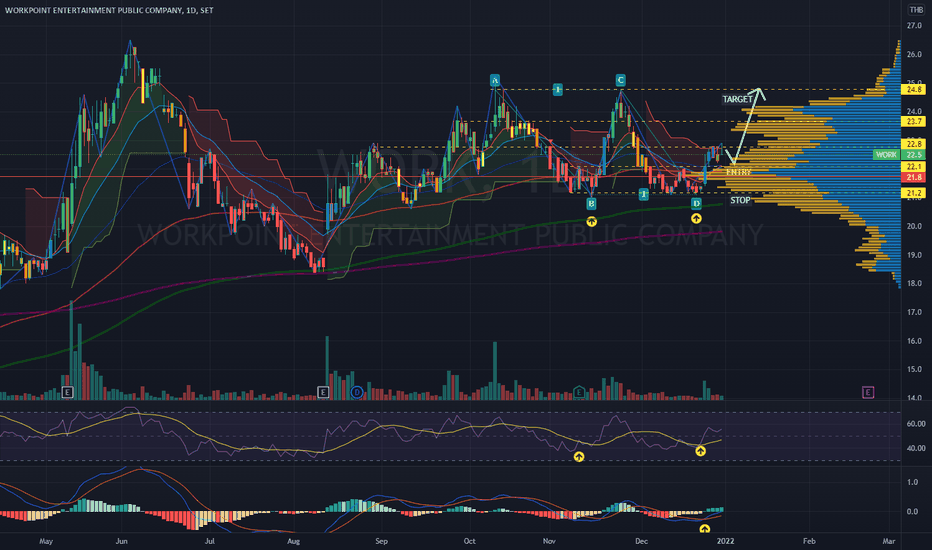

One of the most critical aspects of successful swing trading and CFD strategies is having a sound plan for when to enter, exit and place stop-loss orders. An entry point is the price at which you decide to enter a position in the market, while an exit point is where you will close out your position once it has reached your desired target or limit. Stop-loss orders protect against potential losses by automatically closing out positions if they reach a certain level below their entry point.

By understanding these concepts and mastering entry/exit points and stop-loss points, traders can increase their chances of market success and minimise overall losses. It is highly recommended that traders use practice accounts to test different entry and exit points before implementing them in live trading. ADSS has an extensive range of CFD markets and practice accounts that traders can use to become familiar with the ins and outs of trading before committing to real capital.

Analyse The Suitable Parameters For Optimal Positions

Regarding swing trading and CFD strategies, technical analysis is the key to success. Knowing what parameters to analyse when looking for optimal entry/exit points and stop-loss orders is also essential. Traders should pay attention to market trends, indicators like moving averages, support and resistance levels, momentum and volume levels, gaps in price, news events, etc.

By understanding the fundamentals of technical analysis and learning to interpret chart patterns correctly, traders can make more informed decisions when executing their trades. Again, using a practice account can be invaluable in helping investors become comfortable with these concepts before applying them in live markets.

Identify The Right Market Conditions For Swing Trading

Swing trading and CFD strategies work best in certain market conditions. As such, traders must identify the right conditions before entering a position. These include low volatility, ample liquidity, good risk-to-reward ratio, and high capital intensity.

By understanding these qualifiers and doing thorough research beforehand, investors can increase their chances of success when trading in the markets. Investing in a CFD platform with powerful charting and research tools, such as ADSS’s MT4/5 platforms, can help traders identify these conditions quicker and more accurately.

Consider Leverage To Maximise Capital Gains

Leverage is a double-edged sword and should be used with caution. Leverage allows traders to magnify their potential gains but also increases the risk of losses if not managed correctly. A high level of leverage can amplify both profits and losses, so it is essential to understand how much leverage is suitable for your trading style.

By understanding margin and leverage and calculating their risk-to-reward ratios, traders can determine if they should take on additional leverage to increase their potential returns or reduce it to minimise losses.

Monitor The Markets To Stay Up-To-Date With News & Data

Finally, staying up-to-date with the markets is vital to successful swing trading and CFD strategies. Traders should monitor the news and market data to gain insight into potential price movements; as such, they can make timely decisions when executing trades. Also, monitoring technical analysis indicators, such as moving averages, support/resistance levels, etc., are essential tools traders can use to stay ahead of the markets.

By following these tips, investors can take their swing trading and CFD strategies to the next level and increase their chances of market success. However, it is still important to note that no matter how well you prepare for your trades, there will always be a certain degree of market risk.

:max_bytes(150000):strip_icc()/Primary-Image-how-to-open-a-swing-trade-account-in-2023-7482220-e6334db2c8334352b9ebaca21ffeb05d.jpg)